Housing supply indicators expose the extent of the capital’s housing crisis as investment in new housing sites nosedives, undermining the Government’s housing ambition

A new report from the Home Builders Federation reveals that housing delivery in London is in a significant crisis and warns that home building targets will be unachievable without intervention to improve the deliverability of homes in the capital.

A lack of support for buyers, excessive bureaucracy, unrealistic affordable housing demands, and huge delays in getting applications approved, especially with the Building Safety Regulator, are all hindering efforts to deliver desperately needed new homes.

With the capital expected to deliver 440,000 of the Government’s 1.5 million new homes target by 2030, housing delivery indicators continue to head in the wrong direction.

Both housing completions and planning permission approvals are falling year-on-year, putting this at significant risk.

The Mind the Gap report highlights that only 30,000 homes were completed in London in the year to June 2025, as measured by the number of new properties issued with Energy Performance Certificates, down 12% from the previous year and significantly below the 2019/20 peak.

Planning permissions have also taken a nosedive, dropping to their lowest level since records began in 2006. Just 966 projects were approved in the 12 months to June 2025.

Adding to the crisis, London's overall share of national housing delivery has also continued to shrink from 20% a decade ago to just 15% today.

Meanwhile, the number of new home building sites starting has fallen by 38%. With the Government’s Standard Method requiring London to deliver 88,000 homes a year, output would need to more than double, increasing by 175%, to meet that target.

This casts serious doubt on the city’s ability to satisfy future needs and contribute to the Government’s goal of 1.5 million homes.

The housing affordability crisis is affecting the entire country. There is a lack of affordable mortgage lending available, and it is the first time in decades that there is no Government support for buyers.

But nowhere is it more acute than in the capital. Londoners face the highest barriers to home ownership in the country, and a first-time buyer would need to save 50% of their discretionary income for more than 13 years to afford a deposit.

Average deposits now amount to nearly seven times annual income after bills. The house price-to-earnings ratio is 11 in London, compared to 7.7 nationwide, and the average cost of a first home is now 17 times the net annual salary of a 22– to 29-year-old.

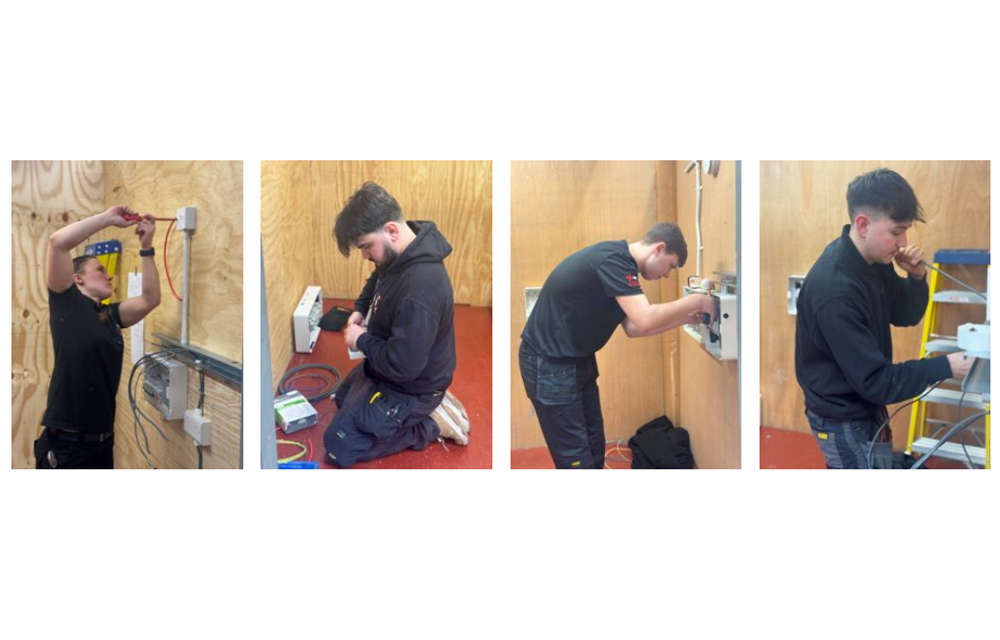

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB

Tools worth over £25 million stolen since 2021

Tools worth over £25 million stolen since 2021

Band of Builders put a call for volunteers to participate in forthcoming projects

Band of Builders put a call for volunteers to participate in forthcoming projects