The slight uplift has been driven by a need to replenish stock following the Q2 construction activity

New timber import figures covering Q3 2025 reveal an ongoing mixed picture for the sector, with year-to-date volumes still trailing 2024 but showing some signs of improvement as the year progressed.

The latest statistics from Timber Development UK confirm that total imports in the first nine months of 2025 reached 7.01 million m³ – some 2.1% below the 7.15 million m³ recorded in the same period of 2024.

This gap has narrowed since the half-year point; however, volumes were down by 2.9%. This slight uplift has been driven by a need to replenish stock after the flurry of construction activity in Q2.

This resulted in a more positive third quarter for imports, with higher volumes than in Q3 2024 across the softwood, hardwood, plywood, OSB, and engineered wood product sectors.

Overall imports for the quarter were only 0.2% lower than Q3 2024, with a marked drop in MDF imports preventing combined volumes from moving into year-on-year growth.

For the year-to-date, solid wood imports from January to September were 2.5% lower than in the same period in 2024, while panel products were down 1.3%.

Weaker demand for softwood and a significant 25% fall in imported MDF remain the main factors holding back overall growth.

By contrast, hardwood, particleboard and OSB imports have all edged ahead of 2024 levels, with hardwood plywood, softwood plywood and engineered wood products also delivering consistent gains throughout 2025.

Softwood import values rose sharply in the nine months to September, increasing by 9% compared with 2024.

Planed softwood values climbed 8%, and sawn goods rose 11%. These increases were driven by a 12% rise in the average price of all softwood imports, despite overall softwood volumes falling by almost 3%.

Pricing data indicate that softwood prices have risen over the past 12 months, diverging from the downward trends seen in sawn hardwood and plywood. Recent months, however, show signs of softwood prices beginning to soften again.

Hardwood imports remained essentially unchanged year-on-year, growing by just 0.2% in total volume.

The USA, Latvia, and France all increased their supplies by 5%, 25%, and 4%, respectively, while Cameroon saw a 19% rise.

Tropical hardwood volumes fell by 3%, despite significant increases from Cameroon and Malaysia, due to reductions from other key supplying countries.

Temperate hardwood imports dropped by around 6%, with declines from Romania, the USA and Estonia offset only by France, which increased volumes by around 2,000m³.

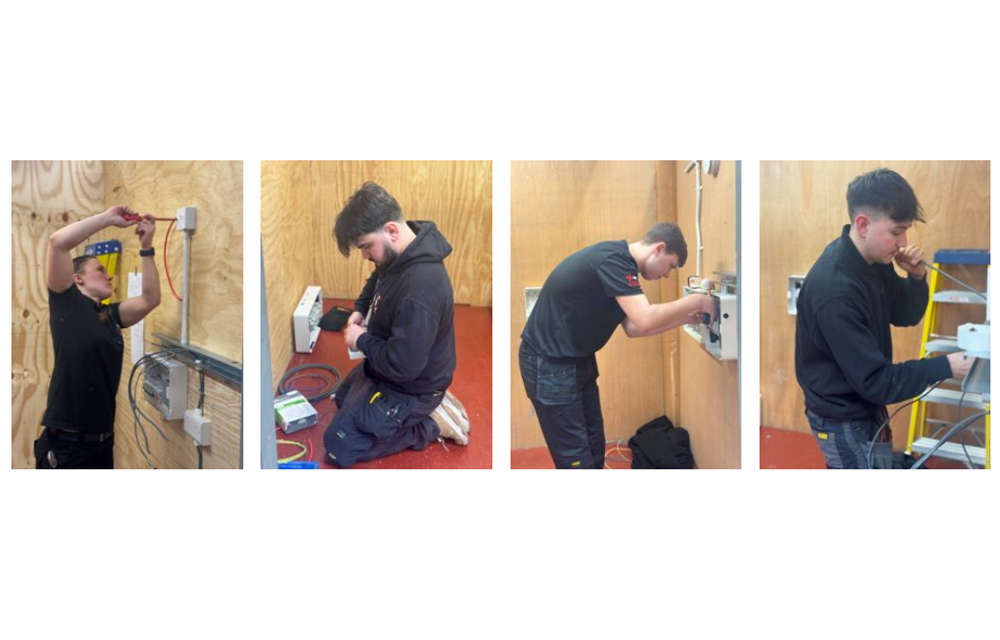

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB