Shocking research from MyBuilder.com reveals that 50% of households have less than £1,000 saved in the bank

Millions of Brits would be unable to afford repairs to their homes should an emergency occur, according to recent statistics.

According to the research from MyBuilder.com, 50% of households have less than £1,000 saved in the bank.

With the average price of emergency home repairs at a four-figure cost, it seems that many residents would struggle to resolve such problems.

Shockingly, 15% have absolutely nothing at all saved, and more than a third (34%) have less than £500 saved.

Those who have less than £1000 saved are from:

- Scotland: 41%

- Wales: 51%

- London: 47%

- West Midlands: 58%

- North West: 55%

- Yorkshire and Humberside: 45%

Common problems that require urgent attention include broken boilers, burst pipes, leaks, and faulty wiring.

The cost for immediate, urgent repair is higher than planned maintenance, and can more than triple if the emergency repair is required out of regular working hours.

The MyBuilder.com data shows that for millions of Brits, an emergency home issue would be impossible to finance, leading to potential debt or remaining living in an unsafe environment.

The data come from a larger study examining knowledge and attitudes toward home maintenance. The figures also show that 42% of Brits don't know what is and isn't covered under their home insurance.

Many emergency issues in homes can be avoided with proper maintenance. Autumn is an ideal time to complete tasks such as boiler servicing and clearing gutters of debris.

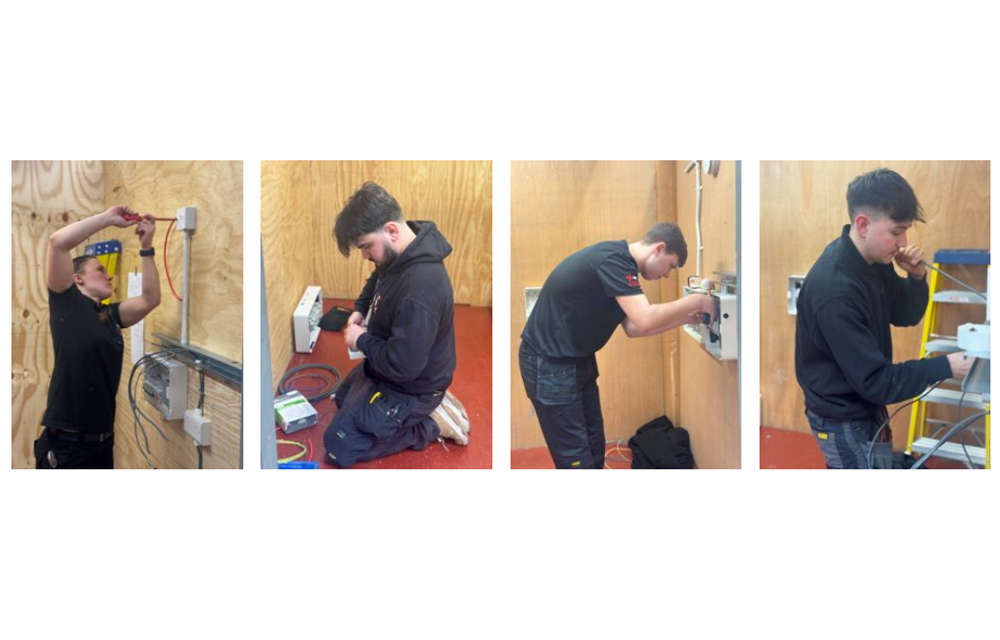

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB