Experts explain the change and what businesses should do to prepare for the switch to digital

From April 2026, as part of the government’s plans to modernise the tax system, self-employed business owners with a qualifying income over £50,000 will no longer submit a single annual tax return. They will instead be required to submit quarterly updates.

Rob Rees, divisional director at Markel Direct, breaks down what HMRC’s Making Tax Digital for Income Tax Self-Assessment is, gives guidance on who will be impacted by the switch and how to prepare best.

HMRC’s Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) will transform how self-employed individuals and landlords report their income.

Instead of a single yearly submission with a deadline of January 31st, those earning over the qualifying threshold will be required to send quarterly digital updates throughout the year, followed by a final end-of-year declaration.

Who Will Be Affected by the April 2026 Changes?

The first phase of Making Tax Digital applies to:

- Freelancers and sole traders earning over £50,000

- Landlords with property income above £50,000

The threshold will be based on the income reported in the 2024/25 tax return, with the government projecting that around 780,000 people will fall into this category.

Those earning between £30,000 and £50,000 will follow from April 2027, based on the income reported in the 2025/26 tax return, whilst those earning under £30,000 are still under review and have the option to sign up voluntarily.

How to Prepare for the Switch to Digital

Tax returns can be daunting for any business, especially for sole traders who manage their tax affairs without an accountant. To help you stay ahead of the game, here are four key takeaways to consider ahead of the transition, to ensure a seamless shift.

- Adopt HMRC-compatible software early: From April 2026, all quarterly submissions will need to be made using HMRC-approved accounting software by sole traders, freelancers and landlords who exceed the qualifying threshold. Spreadsheets and manual uploads will no longer be acceptable.

- Get into the habit of tracking expenses monthly: Instead of storing receipts and invoices for submission at the end of the tax year, get into the habit of recording business transactions monthly.

- Seek professional accounting support: An accountant will be able to provide guidance on whether a self-employed person is meeting the new MTD reporting standards. Engaging one early on, before the system changes, gives time to address gaps in current record keeping and/or software setup.

- Set reminders for quarterly submission dates: From April 2026, sole traders and landlords earning over the £50k qualifying threshold will no longer have just one tax deadline to consider, but instead five. To allow adequate preparation time, individuals should set reminders to avoid any potential late penalties.

You can find more information about Making Tax Digital for Income Tax here.

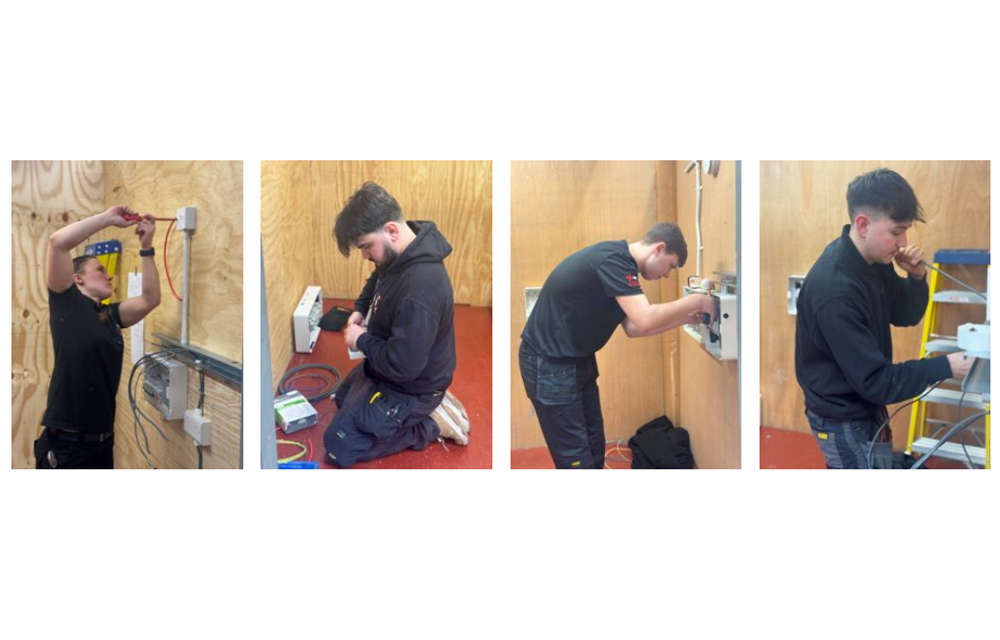

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB