Sage and Checkatrade hosted a parliamentary reception, attended by MPs and trades including plumbers, joiners and decorators

Sage and Checkatrade brought tradespeople, policymakers and technology leaders together in the House of Commons yesterday to spotlight how digital tools and AI can transform the way sole traders run their businesses.

The parliamentary reception, attended by MPs and trades including plumbers, joiners and decorators, focused on the urgent need to accelerate digital adoption as Making Tax Digital for Income Tax comes into force from April 2026.

From that point, sole traders earning over £50,000 will be required to keep digital records and submit quarterly updates to HMRC.

New research from Sage and IPSE shows the scale of the challenge ahead: 70% of UK sole traders are still unaware of the changes. Many continue to rely on pen and paper, losing valuable hours each week to admin and compliance.

Against this backdrop, Sage and Checkatrade showcased how technology can turn a looming compliance burden into an opportunity to save time, improve cash flow visibility and drive productivity.

The event featured a dedicated Tech Zone demonstrating AI-powered tools designed specifically for sole traders. Sage unveiled its new Making Tax Digital for Income Tax AI Agent, built to help accountants and their clients stay compliant with minimal effort.

Checkatrade highlighted TradeMore, its entry-level job management platform that helps tradespeople manage jobs, customers and paperwork in one place.

To show how these tools work in practice, Monzo demonstrated its new tax filing tool, powered by Sage.

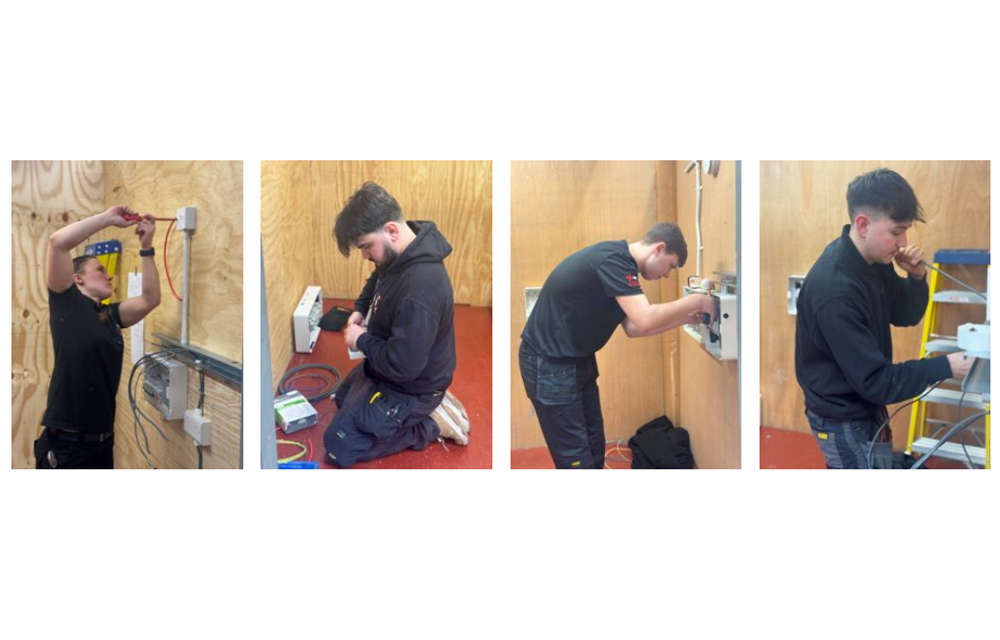

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB