The first six months of 2025 showed the first signs of an improving market, with a 1.9% value growth for the year's first half

The latest Forecast Report from the BMF (Builders Merchants Federation), reveals a slight upward adjustment to 2.5% in the baseline forecast for sales of building materials in 2025, due to marginally better-than-expected growth rates in the first half of the year.

The first six months of 2025 showed the first signs of an improving market, with a 1.9% value growth for the year's first half.

Despite this relatively positive start to the year, there remains a sense that more should be done now. The baseline forecast 2026 remains unchanged from the BMF’s Spring Forecast at 3.1%, although lower and upper forecast scenarios are also provided due to continued economic uncertainty.

The BMF Forecast combines a comprehensive analysis of merchant market performance, drawn from the Builders Merchants Building Index, regarded as the key indicator of current RMI activity, with an examination of key factors affecting builders’ merchants to project future sales for 2025 and 2026

A closer investigation of the year to date shows that there has been a degree of variance in the strength of builders’ merchants’ sales, with some parts of the country and specific sales channels performing better than others.

Historically, a key barometer of economic activity, London has not performed as well as other regions, notably the North East. One reason for the regional disparity is increased price competition in areas with higher clusters of merchants.

Another is the disparity in the cost of living. Higher living costs reduce the disposable income for home improvement projects that drive RMI activity, making consumers wary of upsizing their homes and taking on higher mortgages.

Furthermore, while merchants have seen modest growth in ex-stock sales, the downward trend in direct-to-site sales continues, with some reporting double-digit declines.

Price growth throughout the sector has also been slower than expected, with the two largest categories, Heavy Building Materials and Timber & Joinery, recording year-on-year price deflation of 2.4% and 2.8% respectively, for the first half of 2025.

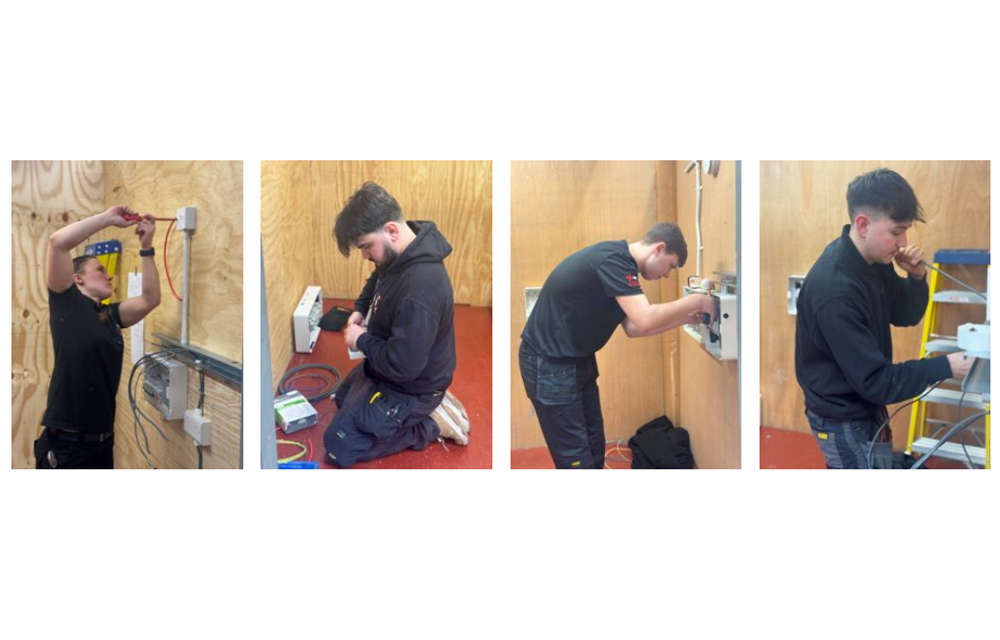

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB