The increased allowance will enable spouses or civil partners to transfer up to £5m in qualifying business assets between them

The BMF (Builders Merchants Federation) has welcomed the government’s plan to raise the Business Property Relief threshold for Inheritance Tax from £1.0m to £2.5m when it is introduced as part of the Finance Bill in April 2026.

The increased allowance will enable spouses or civil partners to transfer up to £5m in qualifying business assets between them, in addition to existing allowances, before paying inheritance tax.

John Newcomb, CEO of the BMF, said: “The BMF has been lobbying the government for over a year, alongside colleagues at Family Business UK and other sectors, notably the farming community. We have provided real-world examples of serious harm to businesses affected by these changes.

“We are pleased that ministers have listened to the concerns of numerous family-owned, multi-generational local independents in building materials and other major supply chains and have altered their policy in light of the overwhelming concern."

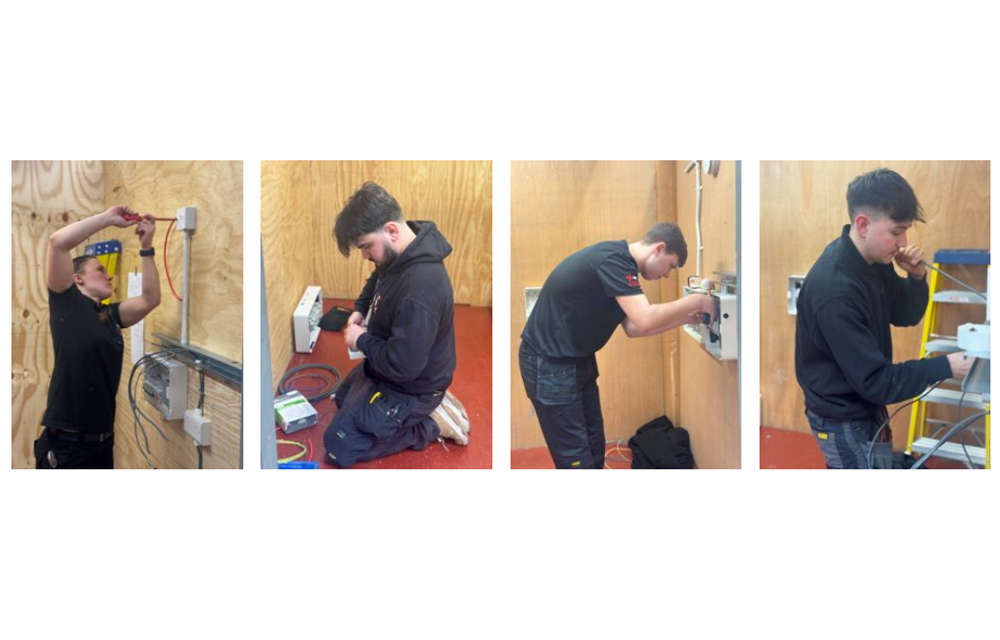

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

AUDIO NEWS: Contractors warned about fake CSCS card checks and Charlie Mullins warns of AI bloodbath

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB