HMRC's Craig Ogilvie gives a lowdown on Tax Digital, while decorator Jon Graham lists the positives the new regulation will bring out

Clive Holland is joined by Craig Ogilvie, director of Making Tax Digital at HMRC, to learn if the new tax regime will make life easier or mean more struggles for hardworking tradespeople.

The government claims that Making Tax Digital for Income Tax is a new way for sole traders to report their income and expenses to HMRC.

This is said to make life easier for taxpayers by splitting and spreading the admin across the year rather than a final rush to submit a tax return. Tax Digital is the most significant change since HMRC launched Self Assessment over 30 years ago.

Craig says that making tax digital is an approach that will help taxpayers avoid errors and make their annual tax return easier by allowing them to file in chunks throughout the year.

"We've already successfully landed this with over two million VAT-registered businesses, and over the next few years, we'll expand that to 2.75 million sole traders and landlords. We're doing this to help businesses/ individuals get their tax right while avoiding the worry and cost when things go wrong," he says.

Details of Tax Digital

- Sole traders with a qualifying income of more than £50,000 need to sign up before 6 April 2026

- Use Tax Digital compatible software

- Create, store and correct digital records of self-employment and expenses

- Send regular light-touch updates every quarter before the end-of-year tax returns to HMRC

- Submit tax return by 31 January the following year

Jon Graham from JG Decorator believes it will be better in the long run for busy tradespeople.

He adds that the HMRC website has a lot of information. "There are also free seminars to help tax players understand how it will change.

"One thing I've found helpful is integrating AI into how I do some of the paperwork. ChatGPT can explain how the new tax regime will impact your business; it gives a concise point-by-point list."

Listen to the full podcast here.

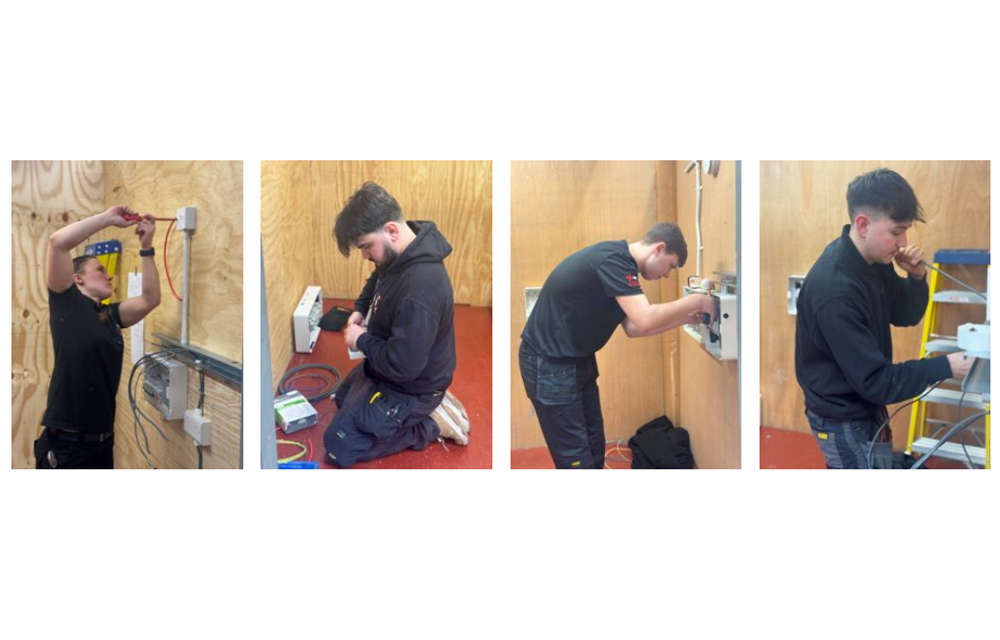

JTL holds Apprentice of the Year Assessment Day

JTL holds Apprentice of the Year Assessment Day

Construction workplace illnesses hit 28,000 annually

Construction workplace illnesses hit 28,000 annually

Fall in R&M building work signals a tough year for builders: FMB

Fall in R&M building work signals a tough year for builders: FMB

Tools worth over £25 million stolen since 2021

Tools worth over £25 million stolen since 2021

Band of Builders put a call for volunteers to participate in forthcoming projects

Band of Builders put a call for volunteers to participate in forthcoming projects